Dave Ramsey and his battle against debt has swept the nation and has rescued countless numbers of hard working men and women that have been willing to “live like nobody else so that they can live like nobody else.”

Photo by Ehud Neuhaus on Unsplash

The problem is that his tools and techniques are fantastic for the hard-working, nine-to-five, W-2 employee that represents a healthy portion of the baby boomer generation. The generation that is now stuck between undelivered promises of pensions and social security and a new generation that entered the work-force understanding that their retirement depended 100% on their own efforts to save money and prepare for the future.

These men and women will have to work forever. And Walmart can only hire so many door greeters…

Photo by Ray Hennessy on Unsplash

But you are different. You chose to breach out into the wild unknown with your own business. You eat what you kill and are thriving…or are you?

It is possible to do many jobs for a healthy profit, and have a healthy-looking business on the outside, but still not have cash in the bank. The problem is Cash Flow vs. Debt.

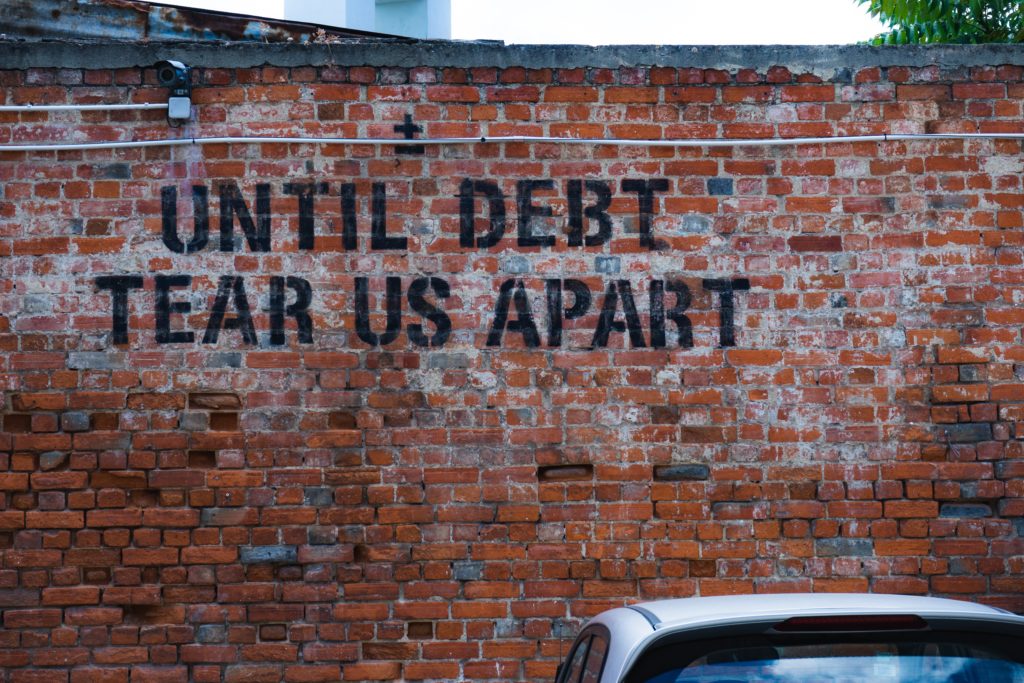

The middle-class, and even many of the upper-class, have been raised with the pre-conceived notion that debt is BAD! If you like the tinfoil-hat-wearing direction for things, it is completely manufactured by a small group of people controlling you and keeping you as servants!

But really, think for a moment about why you want to be out of debt. Is it because you want the millstone off your neck or because you want one less payment each month? One less payment that you can now use for a more abundant life, or perhaps to invest and create even more wealth for yourself.

People like Warren Buffet do not see debt as bad, they see negative cash flow as bad. He understands that a deal that would cost him a $100 debt payment each month is well worth it if that deal brings in $500 a month. You just don’t see him going out to buy a new car on the regular because there is no positive cash flow in that purchase–unless he decides to start driving for Uber.

Let me describe quickly the cash flow problem you are having. You bring on a new client and that client is going to pay you at the end of the project. This is called Receivables. In the meantime, you still have to pay payroll, vendors, utilities, rent, etc., etc. They are not going to wait until you get paid before they will demand payment, especially the employees.

You are stuck in a situation where you have extended a short-term loan to your customer, but have no cash in reserves to get you by until you finish the project and get paid by your customer.

Photo by Madison Kaminski on Unsplash

There are solutions for your cash flow and they involve debt.

So unless you have a large cash reserve set aside and can afford to extend loans to your customers for the duration of the project, you need debt to keep your business going.

There are several options for the debt, some involving interest only payments, which are very manageable in the interim and really need to be built into your estimate for the customer.

Regardless of the tools you use to fix the problem, it is very important to realize that unless you have a large store of cash you can use for lending, running a cash only business, as Dave Ramsey recommends, will kill you slowly. And sadly, the bigger the project, the more quick the hurt comes, making it very difficult to grow.

We can help with you cash flow!

Call, text or email me today!

I can help you build your business on a secure FOUNDATION!